The rise of startups in the USA isn't just about audacious entrepreneurs with big dreams. It's also about the river of money powering them from behind.

Think about it: in a mere decade, venture capital has shifted gears, moving faster and smarter.

With more than 1,000 active VC firms in the U.S., and the global industry surging with a staggering 20.1% CAGR projected through 2027, there's no denying its dynamism.

Giants of today? Many started with that crucial VC boost. Ready to dive into the world of venture capital for your game-changer idea?

Let's walk through the very best VC firms in the United States that could help your startup soar.

Venture Capital Firm

Venture Capital Firm: What is it?

Venture Capital (VC) firms are the financial architects behind innovative startups and promising small businesses.

By providing capital, technological know-how, or managerial expertise, they fuel long-term growth potential. It's more than just money; it's about believing in ideas and transforming them into industry-changing realities.

In the complex landscape of private markets, VC firms stand as both mentors and investors, nurturing the future of business.

How Does it Work?

Picture a VC firm as the savvy matchmaker in the bustling world of business.

On one side, you've got founders bursting with groundbreaking ideas but in need of funds. On the other, investors with the capital, eager to back the next big thing.

VC firms bridge this gap. They scout promising startups, infuse them with not just funds but also mentorship, and in return, take a slice of the company's equity.

For investors, it’s about seeing their money amplify. For startups, it’s about turning visions into reality.

In essence, VC firms make dreams meet means.

20 Top Best VC Firms in the USA

In the sprawling landscape of American venture capital, some firms stand out from the crowd. Curious about the powerhouses shaping tomorrow's innovations?

Let’s dive into the top 20 VC firms making waves in the USA:

1. Andreessen Horowitz

Andreessen Horowitz: Silicon Valley's Trailblazer, Hailing from the tech heartland, Menlo Park, California, often dubbed "a16z" is a titan in the venture capital scene.

Founded in 2009 by tech visionaries Marc Andreessen and Ben Horowitz, this relative newcomer has swiftly risen to dominance, amassing a whopping $35 billion in assets under management.

Their keen eye has played a part in the ascension of giants like Twitter, GitHub, and Stripe.

Their reputation? Simply put: a modern VC firm with a futuristic outlook.

Ideal For:

- Startups of All Stages: Whether you're in the embryonic seed stage or sprinting through late-stage growth, a16z has the expertise and appetite to catapult you further.

- Fintech Startups: Their portfolio gleams with names like Stripe and Coinbase. If you're aiming to disrupt the financial sphere, a16z might be your best bet.

- Cryptocurrency Enthusiasts: With investments in groundbreaking projects like Libra and a keen interest in blockchain, they're at the forefront of the crypto revolution.

2. Sequoia Capital

With nearly half a century of experience, Sequoia Capital has earned its reputation as a leading light in venture capital.

Based in Menlo Park, California, and boasting a robust $28.3 billion AUM, Sequoia Capital has shaped the success stories of tech giants like Google, Apple, and Oracle.

Their investment reach extends globally, touching various industries from energy to healthcare, and their winning investment-to-exit ratio is proof of their mastery.

Simply put, Sequoia Capital is the name synonymous with success in the tech world.

Ideal For:

- Tech Startups: From Apple to NVIDIA, their alumni list reads like a who's who of tech. If you're building the next big thing in tech, you'll want Sequoia on your side.

- High-Growth Startups: If your startup has the potential to soar, Sequoia's unparalleled experience and global reach can fuel that ascent.

- Healthcare Startups: With a history of investing in various healthcare innovations, they have the insight and network to nurture medical breakthroughs.

- Early-Stage Startups: With a flexible approach covering early to late stages, whether you're just planting the seeds or expanding branches, Sequoia Capital may be the growth partner you're looking for.

3. Bessemer Venture Partners

Nestled in the tech hubs of Redwood City and San Francisco, Bessemer Venture Partners boasts an illustrious five-decade legacy.

They've expertly steered the journeys of standout companies like Pinterest, Shopify, and LinkedIn.

With a robust $20 billion AUM, Bessemer stands as a beacon, lighting up the path for startups with transformative ideas and the zeal to redefine industries.

Pioneering change, they not just invest, but form lasting bonds, guiding entrepreneurs every step of the way.

Ideal For:

- Enterprise Startups: With a rich history of backing solid enterprise solutions, Bessemer knows the nuts and bolts of scaling B2B ventures.

- Consumer Product Startups: Recognizing potential consumer unicorns early on, they've been part of success tales like Pinterest and Shopify, signaling their consumer market acumen.

- Healthcare Startups: In the vast realm of healthcare, Bessemer dives deep, financially fostering startups that aim to revolutionize healthcare delivery and solutions.

4. Citi Ventures

Citi Ventures, nestled in Palo Alto, CA, has consistently been at the forefront of technological and financial innovations since its inception in 1974.

With a commitment to exploring uncharted territories in a rapidly changing world, they are geared towards investing in startups that embody the future.

Their dedication to next-gen technologies has led them to noteworthy investments such as C2FO, Docker, and Honey.

For those who dream big in the domains of fintech, data analytics, commerce, and security, this powerhouse is more than just a financier; it's a partner in innovation.

Together with Citi Ventures, your revolutionary idea could be the next big thing, redefining sectors and setting benchmarks. Ready to partner?

Ideal for:

- Fintech Startups: If you're poised to redefine financial paradigms, Citi Ventures is your compass. With laurels like C2FO, they've mastered the fintech terrain.

- Data Analytics & Machine Learning: For trailblazers in data, they offer unparalleled support. They've championed ventures that decode complex data into groundbreaking solutions.

- Future of Commerce: Crafting the next e-commerce sensation? They’ve backed ventures reshaping trade and transactions for the digital age.

- Security & Enterprise IT: With a digital realm prone to breaches, they're hunting for ventures ensuring robust, impenetrable cyber fortresses.

5. Khosla Ventures

Emerging from the tech-centric hub of Menlo Park, California, Khosla Ventures stands as a testament to forward-thinking investment strategies.

Founded in 2004 by the innovative Vinod Khosla, previously associated with Kleiner Perkins, it swiftly became one of the USA's premier VC firms.

Despite being one of the younger players in the VC arena, it's impressive $15B AUM and strategic investments in disruptive technologies—from Stripe to DoorDash—underline its prowess.

Khosla's sharp focus on both the US and China and its standout investment-to-exit ratio showcases its commitment to fostering game-changing startups.

Ideal For:

- Education Initiatives: Transforming traditional learning platforms, Khosla bets on ventures reshaping the educational paradigm for future generations.

- Health & Wellness Visionaries: Startups with a mission to enhance holistic well-being and revolutionize healthcare receive Khosla's backing.

- Food & Beverage Innovators: Pioneers introducing fresh concepts to the dining table or revolutionizing beverage experiences find a partner in Khosla.

- Robotics Enthusiasts: Groundbreakers developing cutting-edge robotics solutions that promise to redefine industries and lifestyles get Khosla's attention.

- New Enterprise Associates (NEA)

6. New Enterprise Associates (NEA)

From its roots in Chevy Chase, Maryland, New Enterprise Associates (NEA) has towered over the VC landscape for close to half a century.

Established in 1977, it quickly asserted its dominant presence globally, managing assets north of $20B.

With a strategic emphasis that stretches from tech titans like Uber to healthcare pioneers such as 23andMe, NEA's diverse portfolio is a testament to its vision.

Their ability to pinpoint and back transformative ideas, irrespective of the sector or stage, is perhaps why it's often considered the gold standard in venture capital in the USA.

Ideal For:

- Tech Startups: NEA's foresight in tech has led to partnerships with luminaries like Uber, Cloudflare, and Duolingo—offering unrivaled expertise and networks.

- Healthcare Startups: With investments in groundbreaking ventures like 23andMe, NEA propels startups reimagining healthcare's future.

- Early-Stage Startups: Dedicated to igniting transformative ideas from the get-go, NEA provides substantial backing to early visionaries shaping tomorrow.

7. Founders Fund

Hailing from the tech hub of San Francisco, the Founders Fund, with an AUM of $11B, stands tall among the global venture capital giants.

Spearheaded by visionaries like Peter Thiel and Sean Parker, the minds behind PayPal and Napster, this firm has a knack for backing the next big thing.

Their portfolio boasts heavyweights like Airbnb, Lyft, Spotify, and Stripe. The 2022 eighth flagship fund, amassing $5 billion, further amplifies their commitment to innovative excellence.

There's no denying, Founders Fund is synonymous with bold investment, game-changing innovation, and business acumen.

Ideal For:

- Growth-Stage Startups: Founders Fund's expertise in scaling startups is legendary, transforming ventures like Airbnb and Lyft into global brands.

- Tech Startups: With investments in Stripe and Deepmind, their technological acumen fosters innovation in diverse tech landscapes.

- Space Exploration Startups: By backing SpaceX, the Founders Fund fuels ambitions beyond Earth, propelling startups aimed at cosmic exploration.

8. First Round Capita

With an AUM of $3B and headquartered in San Francisco, First Round Capital has forged a unique identity in the world of venture capital.

Unlike typical firms, their focus is squarely on the seed stage, committing to innovative startups like Uber, Square, and Warby Parker right from their infancy.

Established in 2004 by Howard Morgan, Josh Kopelman, and Todd Jackson, First Round's philosophy extends beyond just funds.

It offers hands-on partnerships, strategic insights, and a community-driven approach to shape the next generation of disruptors.

Ideal For:

- Seed-Stage Startups: Specializing in the very first stages of company creation, First Round Capital is a haven for early visionaries.

- Startups Seeking Hands-on Partnership: With a team of active partners and ex-founders, they offer tailored support for strategy and organizational design.

- Community-Centric Startups: Pioneering a portfolio community concept, First Round fosters collaboration, enabling startups to learn from and support their peers.

9. Y Combinator

Y Combinator, hailing from Mountain View, and founded in 2005 by an ensemble of visionaries, including Jessica Livingston and Paul Graham.

It is more than just a venture capital firm; it's a launchpad for dreamers and disruptors.

YC's vast expertise spans an incredible array of industries, from SaaS to Sustainability, with its fingerprints on billion-dollar unicorns like Coinbase, Twitch, and Reddit.

They don't just provide funds; they empower founders, regardless of age, to craft products that resonate with users and achieve unparalleled growth.

Ideal For:

- Early-Stage Visionaries: Y Combinator specializes in uplifting startups at their most nascent stages, offering unparalleled mentorship and resources.

- Founders Targeting Rapid Growth: With a rich history of nurturing billion-dollar unicorns, YC equips startups for explosive success.

- Innovators Seeking Comprehensive Industry Expertise: YC’s vast industry knowledge, ranging from Aerospace to Fintech, provides tailored guidance for diverse innovation spheres.

10. 500 Global

With its roots in San Francisco and branches stretching to every corner of the world, 500 Global is not just a venture capital firm—it's a global powerhouse breathing life into trailblazing tech endeavors.

Founded in 2010 by visionaries Christine Tsai and Dave Mcclure, this venture titan has managed an impressive $2.5 billion in assets, turning startups into success stories with the likes of Canva, Solana, and Reddit under its belt.

It's not just about the investment; it's about tapping into a world's potential and nurturing it. With a presence in over 20 countries, 500 Global's secret weapon is its globally-experienced team, poised to guide startups through their unique challenges and propel them to greatness.

Ideal For:

- Global Ambition Startups: With team members in 20+ countries, 500 Global specializes in transforming global visions into reality.

- Tech Trailblazers: Investing across diverse tech sectors like SaaS, Fintech, and Blockchain, they empower next-gen technological innovations.

- Early-stage Disruptors: Their focus on seed and early stages means they recognize and nurture potential from the outset.

11. Dragoneer Investment Group

Located in San Francisco, Dragoneer Investment Group stands as a beacon for innovative businesses ready to leap into their next big stage.

With a staggering $24B under management, Dragoneer doesn't just invest; they partner, mentor, and prepare companies for the spotlight of the public market.

Their prowess lies in spotting tech-enabled gems and guiding them through the intricate dance that precedes an IPO.

By forgoing traditional fundraising pathways and leveraging methods like secondary stock sales, they've streamlined the investment process, making it more efficient for the modern world.

Their track record? Just look at giants like Alibaba, Slack, Spotify, and DoorDash, and you'll see Dragoneer's guiding hand behind their successes.

Ideal For:

- Tech-Driven Companies: Focusing exclusively on technology-enabled businesses, Dragoneer is the catalyst for tech-centric exponential growth.

- Growth-Stage Ventures: With an affinity for entities at the cusp of maturity, they're experts in amplifying growth potential.

- IPO Aspirants: Their specialty lies in guiding businesses on the brink of IPO, ensuring a smooth transition to public markets.

12. Deerfield Management

Founded in the heart of New York in 1994, Deerfield Management emerges as a titan in the venture capital world, exclusively championing the healthcare sector.

Boasting a commanding $16B AUM, Deerfield is no ordinary venture capital firm. They are partners, collaborators, and pioneers.

But their commitment doesn't end at investment. Through the Deerfield Foundation, they take philanthropy to heart, ardently advancing children's health worldwide.

This synergy of investment expertise, philanthropic passion, and an unyielding focus on healthcare sets them apart as a beacon in the industry.

With laudable deals like Akari Therapeutics and Exelixis under their belt, they have indeed etched their mark on the healthcare ecosystem.

Ideal For:

- Healthcare Innovators: Deerfield’s expertise lies in nurturing healthcare ventures, turning revolutionary ideas into groundbreaking realities.

- Diverse Funding Seekers: Offering a plethora of financing models, they're a one-stop shop for varied healthcare funding needs.

- Philanthropic Endeavors: Beyond investment, their dedication to global children’s health makes them an unparalleled partner for purpose-driven entities.

13. Lightspeed Venture Partners

Founded in the tumultuous year of 2000, Lightspeed Venture Partners, headquartered in Menlo Park, CA, has emerged as an unstoppable force in the venture capital landscape.

With an impressive AUM of $18B, they are experts at turning bright ideas into blazing successes.

Their portfolio sparkles with renowned names like Grubhub, Snap, and Rubrik.

With locations across the globe including Silicon Valley, Israel, China, and Southeast Asia, they bring international growth opportunities to the table.

Through their specialized support in areas like marketing and IPO planning, they provide a full spectrum of assistance that extends beyond just financial investment.

Ideal For:

- Early-Stage Startups: With flexible check sizes and a diverse range of industries, Lightspeed nurtures start-ups from their infancy.

- Healthcare Innovations: Specializing in the health sector, they provide unparalleled expertise and guidance in this critical and burgeoning field.

- Consumer Technologies: With a focus on early adopters and a strong portfolio in consumer tech, they're an optimal partner for consumer-driven ventures.

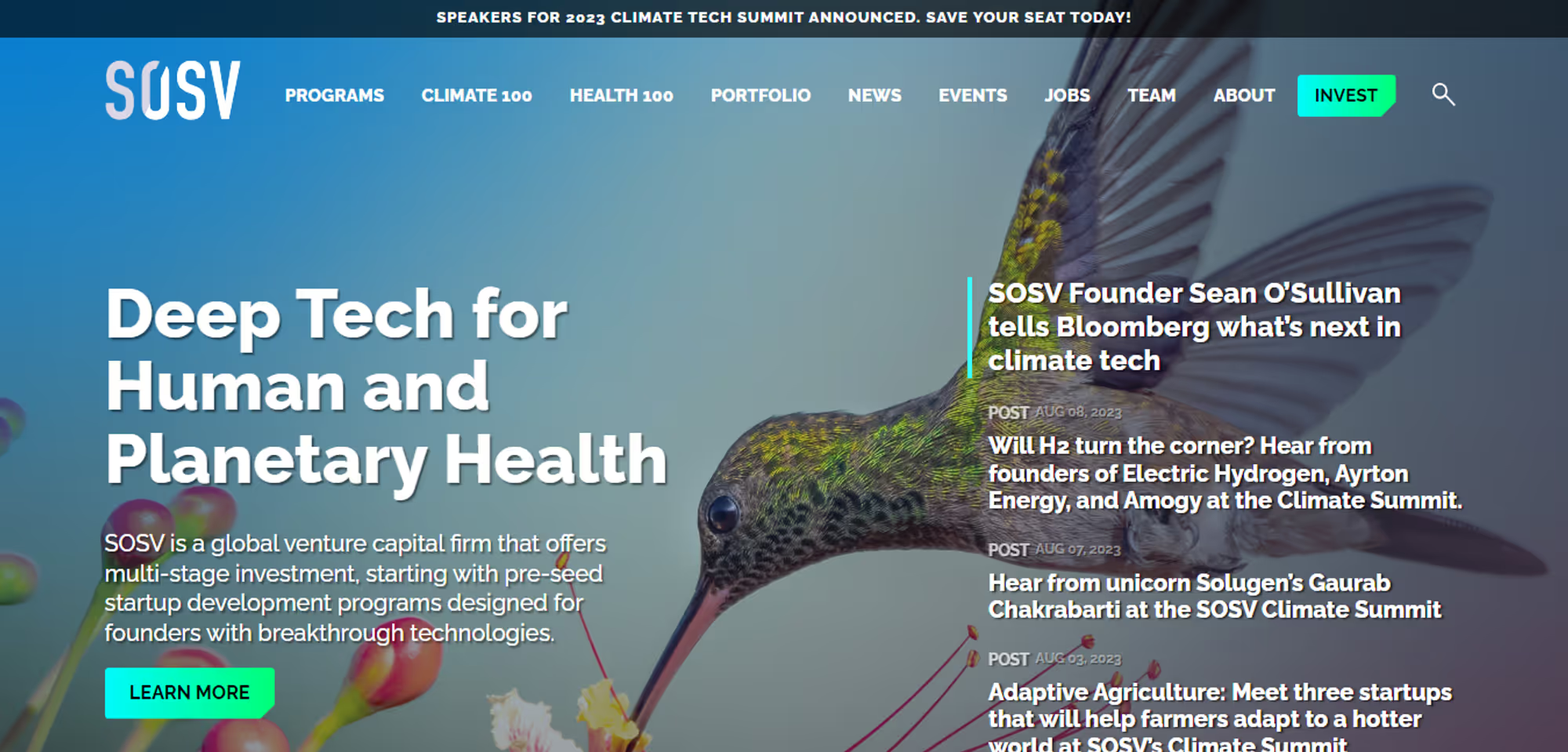

14. SOSV

Founded in 1994 by Sean O'Sullivan, SOSV is an international venture capital titan focusing intensely on deep tech innovations.

From the bustling streets of New York to the dynamic hubs of Shanghai and Taipei, they've entrenched themselves in the technological epicenters of the world.

Their diverse investment portfolio, which spans sectors like AI, robotics, and sustainability, is a testament to their expansive vision.

Beyond just funds, SOSV offers startups a robust growth trajectory, backing them from pre-seed to growth stages, all while championing the noble cause of human and planetary health.

SOSV is globally recognized, not just for its $1.5 billion assets, but for its commitment to fostering human and planetary health through innovation.

Ideal For:

- Deep Tech Startups: SOSV specializes in backing pioneering technologies, guiding them from inception to full-scale operations.

- Health & Sustainability Ventures: Through programs like IndieBio, they are at the forefront of innovations in human and planetary well-being.

- Global Expansion Goals: With footprints from NYC to Taipei, they provide startups with an unparalleled global reach and expertise.

15. Accel

Emerging from the bustling tech epicenter of Palo Alto in 1983, Accel grew from being a homegrown Californian success to a global venture capital titan.

With a whopping $50B+ under its belt, Accel doesn't just invest, it partners. Be it a budding idea in its infancy or a growth-stage sensation ready to disrupt markets, Accel's been there, and funded that.

From household names like Facebook and Dropbox to game-changers like Discord and Hootsuite, Accel's legacy is vast and varied.

What sets them apart? Their unwavering belief in "investing in people and their companies" from the get-go.

Their mission? To catapult businesses from their earliest days through every tantalizing twist and turn of private company growth.

Ideal For:

- Tech Startups: Pioneers in backing innovative tech solutions. They've powered the likes of Dropbox and Hootsuite.

- Early-Stage Startups: Right from the seed stage, Accel sees potential and helps it flourish.

- Growth-Stage Startups: Scaling up? Accel's vast resources and experience pave the way for startups ready for explosive growth.

16. Intel Capital

Picture this: a venture capital firm that doesn't just invest but foresees the future. Meet Intel Capital, a beacon from the esteemed house of Intel Technologies.

Founded in 1991 and rooted in Santa Clara, this VC powerhouse has committed over $12 billion to catalyze the growth of groundbreaking tech across the globe.

With a focus as wide as cloud and AI to as niche as gaming hardware, Intel Capital's vision is clear: to champion innovation.

Its reputation? Well, having backed monumental players like Razer, Animoca Brands, and Docusign pretty much seals the deal.

In the ever-evolving world of tech, Intel Capital stands tall, committed to steering the ship of innovation.

Ideal For:

- Tech Startups: Proven backers of revolutionary tech platforms. Remember Razer and Docusign? Yep, that's them.

- Minority Founders: A dedication to inclusivity; Intel Capital champions diverse ideas and voices.

- Artificial Intelligence Startups: With AI shaping our future, Intel Capital ensures these startups have robust support.

17. Tiger Global Management

Imagine a venture capital firm not just with deep pockets, but a deeper understanding of the tech ecosystem. Welcome to Sapphire Ventures, an oasis for tech innovators.

With hubs in iconic cities like Austin, San Francisco, and London, this Menlo Park-rooted titan stands out as one of the world's top-tier VCs.

From seeding young sports and media start-ups to propelling Series B ventures toward IPOs, they're not just investors but visionaries.

Their eye for enterprise software has led them to back giants like Docusign and Monday.com. With a whopping $8.8 billion raised, isn't it time you knew them better?

Ideal For:

- Enterprise Software Pioneers: Specialists in driving B2B companies in enterprise software sectors to unparalleled heights.

- Diverse Start-Up Stages: From early seed to the critical Series B phase, Sapphire is your growth partner.

- Tech-focused Visionaries: With investments in domains like AI, DevOps, and fintech, they champion cutting-edge innovation.

18. Tiger Global Management

Tiger Global Management, the New York-headquartered giant, isn't just any VC firm. It's an investing behemoth.

With assets that impressively span across venture capital, private equity, and hedge funds, their footprint in the tech world is undeniable.

With iconic investments in game-changers like Coinbase and Meta, they have established themselves as the go-to for companies dreaming big.

Founded by the visionary Chase Coleman, a prodigy of the renowned Julian Robertson, Tiger Global is the epitome of financial acumen and tech-savvy.

Their $36.1 billion funds raised isn't just a number but a testament to their unmatched prowess in the investment world.

Ideal For:

- Tech Trailblazers: Specializing in internet, software, and fintech sectors, they nurture next-gen technological innovations.

- Growth-Stage Startups: From Series B to Series C, Tiger Global powers businesses preparing for monumental leaps.

- Diverse Investment Seekers: Beyond VC, their expertise in public equity and long-only strategies offers expansive investment avenues.

19. GGV Capital

Founded in the new millennium, GGV Capital is not just any venture capital firm; it’s a bridge connecting bright minds from the East and the West.

With its rich lineage rooted in both Silicon Valley and Singapore, it has blossomed into a global titan, marking its presence from San Francisco to Beijing.

Managing an impressive $9.2 billion in capital across 17 funds, the firm's investments speak for themselves.

Names like Airbnb, Slack, and JD.com are not just success stories but a testament to GGV's belief in transformational technology.

Their commitment isn't just to tech but to the visionaries who dare to reimagine the world, irrespective of where they come from.

Ideal For:

- Growth-Stage Startups: Turning visionaries into industry leaders, they excel in catapulting startups to their growth zenith.

- Early-Stage Pioneers: At the inception, when dreams are fragile, GGV Capital offers both capital and mentorship.

- Smart Tech Innovators: A passion for disruptive tech solutions that revolutionize markets? GGV's portfolio says they're your best bet.

20. Kleiner Perkins

Located in the heart of Silicon Valley, Menlo Park, Kleiner Perkins isn't just a venture capital firm; it's a legacy.

For 51 illustrious years, Kleiner Perkins has been the bedrock behind some of the most transformative companies our world has seen.

From the early days of the internet with AOL to game-changers like Amazon, Google, and Twitter, their portfolio reads like a 'Who's Who' of the tech universe.

With a whopping $9 billion managed across numerous funds, they've not just witnessed but actively propelled the tech revolution.

Their commitment to nurturing innovation remains unchanged as they've backed over 900 ventures, acting as both the wind and anchor to countless entrepreneurial sails.

Ideal For:

- Tech Visionaries: With successes like Google and Amazon, they're proven allies for transformative tech aspirations.

- Early-Stage Innovators: Their track record shouts expertise in identifying and nurturing budding entrepreneurial dreams.

- Growth Ambitions: From seed to scaling, their experience in fostering growth is unparalleled in the VC landscape.

Conclusion

The venture capital landscape is teeming with potential, and as the age-old adage suggests, a groundbreaking idea is unmatched in its power.

Yet, as VC firms grow and the stakes rise, seamless organization becomes paramount. The adoption of virtual deal rooms by top-tier firms and their investees is a testament to the evolving nature of the industry.

For budding entrepreneurs, this isn't just about securing funds, but about fortifying trust. As you navigate the exciting world of investments, ensuring our data's security and accessibility isn't just advisable; it's imperative.

Here's to harnessing the best tools, to make those groundbreaking ideas shine even brighter!